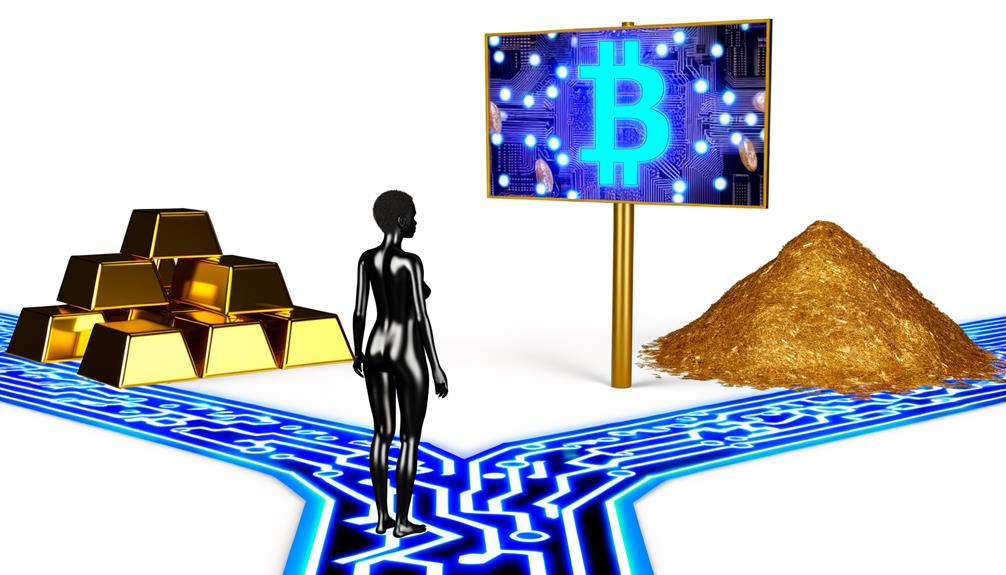

Exploring the age-old debate of Gold versus Bitcoin, I weigh the pros and cons of these investment choices.

As I analyze the stability of gold and the volatility of Bitcoin, a clearer picture emerges regarding which asset might align better with my investment goals.

The article raises thought-provoking points on utility, rarity, and market dynamics, prompting me to reconsider my investment strategy in light of these insights.

Key Differences Between Gold and Bitcoin

Analyzing the key differences between Gold and Bitcoin reveals distinct characteristics that shape their investment appeal and market behavior. Gold, a traditional financial asset, has a long-established reputation as a safe haven during market downturns, offering stability in times of economic uncertainty. In contrast, Bitcoin, a digital currency, presents itself as a modern investment option that challenges Gold's status quo.

One significant disparity lies in their value fluctuations. Gold demonstrated resilience during the COVID-19 pandemic, maintaining its value, while Bitcoin experienced a notable price surge, showcasing its volatile nature. Additionally, Gold serves various industrial purposes, enhancing its utility beyond being a mere investment, whereas Bitcoin primarily functions as a digital currency and speculative asset.

When considering investment choices, Gold's liquidity and ability for quick portfolio adjustments provide investors with a sense of control and security. On the other hand, Bitcoin's liquidity fluctuates, influenced by market demand and speculation, contributing to its high volatility. This volatility makes Gold a preferable option for those seeking a more stable investment environment.

Utility and Liquidity Factors

Gold's diverse utility across various industries sets it apart from Bitcoin, providing a level of stability and broader usability beyond being a capital preservation method. When comparing the utility and liquidity factors of gold and Bitcoin, several key points emerge:

- Gold offers higher liquidity for quick portfolio reallocation compared to Bitcoin.

- Bitcoin's primary use as a digital currency and speculative investment limits its utility compared to gold.

- Bitcoin's liquidity fluctuates based on market behavior, impacting investment decisions.

- Gold allows for easier liquidation, making it a more liquid asset than Bitcoin.

These factors are essential for investors looking to make informed decisions about their portfolios. Understanding the differences in utility and liquidity between these assets can aid in crafting a well-balanced investment strategy that aligns with individual risk tolerance and financial goals.

Rarity Comparison: Bitcoin Vs. Gold

In comparing the rarity of Bitcoin to that of gold, a notable distinction arises in their respective total supplies and mechanisms of issuance. Gold boasts a total estimated above-ground supply of 197,576 metric tons, while Bitcoin's total supply is capped at 21 million coins.

Gold's scarcity is maintained by limited annual production of around 3,000 tons, while Bitcoin's scarcity is algorithmically programmed, with a halving event every four years reducing the rate of new coin creation by half. The precious metal's scarcity stems from geological constraints on mining and costly extraction processes, underpinning its value.

Conversely, Bitcoin's rarity is bolstered by its decentralized nature, cryptographic security, and the escalating difficulty of mining new coins over time. These factors contribute to the distinctiveness of both assets and play an important role in shaping their perceived value in the market.

Investment Comparison: Bitcoin Vs. Gold

Comparing the investment potential of Bitcoin and gold reveals distinct characteristics that investors carefully evaluate when contemplating their portfolio allocations. When deciding between the two, it's essential to assess various factors such as the historical performance, utility, and liquidity of each asset.

Here are some key points to take into account:

- Gold has a long-standing reputation as a safe haven asset during market downturns.

- Bitcoin, on the other hand, presents itself as a modern and decentralized investment option.

- The price of gold remained stable throughout the COVID-19 pandemic, while Bitcoin experienced significant price surges.

- Gold offers higher liquidity and easier portfolio reallocation compared to Bitcoin, which can experience fluctuations in liquidity based on market conditions.

Understanding these distinctions is crucial for investors looking to diversify their portfolios effectively. Seeking advice from a financial advisor can help in formulating a well-rounded investment strategy that incorporates both gold and Bitcoin based on individual risk tolerances and financial goals.

Pros and Cons of Gold and Bitcoin

Are the pros and cons of gold and Bitcoin thoroughly understood by investors seeking to diversify their portfolios effectively?

Gold's historical significance as a hedge against market downturns provides stability during economic crises, making it a popular choice for investors looking for a secure investment. On the other hand, Bitcoin, introduced in 2009, offers a decentralized alternative with the potential for high returns, challenging traditional gold investments.

During the COVID-19 pandemic, gold's value remained steady, emphasizing its stability, whereas Bitcoin experienced a price surge, showcasing its speculative nature. Gold boasts diverse utility across various industries, while Bitcoin primarily serves as a digital currency and speculative investment, highlighting their different functionalities.

Concerning liquidity, gold offers higher liquidation options and allows for quick portfolio reallocation compared to Bitcoin, making it a more liquid asset for investment decisions. Investors must carefully consider these factors when deciding between gold and Bitcoin for their investment portfolios.

Frequently Asked Questions

Is It Better to Invest in Bitcoin or Gold?

I prefer gold for its stability and long-term value, especially in uncertain times. Bitcoin's volatility can offer quick gains but carries higher risks. Diversifying with both could balance a portfolio, considering market trends and risk assessment.

What Happens if You Invest $100 in Bitcoin Today?

Investing $100 in Bitcoin today carries the potential for significant returns or losses due to market volatility. Monitoring price fluctuations, evaluating risks, and diversifying one's portfolio with digital currency are essential for long-term prospects and effective investment strategies.

What Are the Disadvantages of Investing in Gold?

Investing in gold may involve high storage costs and price volatility, limiting upside potential. It doesn't offer dividends, has environmental impacts, and may not always hedge against inflation effectively. Market manipulation, capital gains tax, and counterparty risks are also concerns.

Is Now a Good Time to Buy Gold?

Now is a good time to ponder gold given economic uncertainty and market volatility. Its historical performance as an inflation hedge and safe haven, along with portfolio diversification benefits, make it a prudent long-term investment despite price fluctuations.

Conclusion

To sum up, while both gold and Bitcoin have their unique advantages and disadvantages, one interesting statistic to contemplate is that Bitcoin's market capitalization recently surpassed that of the International Monetary Fund (IMF). This showcases the growing significance of Bitcoin in the global financial landscape.

Ultimately, the choice between investing in gold or Bitcoin depends on individual risk tolerance, investment goals, and market outlook. Investors should carefully evaluate their options to make informed decisions.